Payment Policy

Payment Policy

Our reception staff will be happy to advise you of the consultation fee upon booking an appointment over the telephone. Fees for consultation along with other necessary forms will also be sent to you for your convenience upon booking an appointment.

Surgical fees are billed directly to the Health Insurance Providers.

Where out-of pocket co-payment are required which can vary depending on the type and complexity of surgery or procedure. Patients will be advised, in writing, after the consultation, the amount of gap payment. Fees for uninsured patients are advised by the accounts manager upon request.

For more information on Payment Types click here

How to Pay

Other Payment Choices

Medical Finance Options

There are a range of medical finance specialists who help fund medical procedures, some providers include:

- Zip

- Medipay

Early Release Superannuation

Patients may apply to Centrelink for an early release of superannuation funds to cover part or all of the costs involved. Further details are available on the Centrelink website.

If you choose to apply for this, three documents must be submitted.

Completed application form - ATO Page link for more information

- A letter of support from your General Practitioner

- A letter of support from our clinic (we will provide this after your initial consultation)

Please note that processing time with Centrelink is generally around 3 weeks, and allow a further 4-6 weeks for your superannuation fund to release the funds to your personal bank account.

Tax Rebate Scheme For Medical Expenses

A significant rebate can be claimed through your end-of-year tax return if you incur medical expenses over $2,000 during the one financial year. Anyone can claim the tax offset; there is no upper limit on the amount you can claim.

However, it is now income-tested. The rebate is currently 20 cents per dollar over the $ 2,000 threshold.

There is no upper limit on the amount you can claim, and it is not means- or asset-tested. Because this is a rebate rather than a tax deduction, you can claim this from the ATO even if you do not pay tax. As always, also check with your accountant or financial advisor.

Because this is a rebate rather than a tax deduction, you can claim this even if you do not pay tax. It is contended on question T9 on your tax return. As always, be sure to check with your accountant or financial advisor. Refer to the Australian Taxation Office to know more.

Payment Types

About Private Fee Patients

- choose your own treating specialist, and

- be treated at hospitals that our doctor is affiliated to or is a visiting medical specialist,

- an outpatient clinic or in our private rooms, or

- will be referred to your local general practitioner.

Overview of Payment for Patients

- the billing types our practice offers,

- the billing policies for our medical services, and

- further explanations to common fee questions patients have.

Types of Patients

- Privately Insured Patients,

- Insurance Patients (Workers Compensation, Motor Accidents etc),

- Veteran Affairs Patients,

- Self Insured Patients, and

- Overseas Patients.

Fee Estimates

All Fee Categories

- Hospital Fees,

- Surgical Assistant Fees,

- Implants or Prosthesis Costs,

- Anaesthetists Fees,

- Diagnostic Tests (Radiology, Pathology), and

- Post-Operative Care.

Questions to Ask Your Health Fund

- What is my annual monetary benefit limit for:

- General Surgical treatment and Major Surgical treatment?

- What service limits apply to my cover?

- When does my annual benefit limit expire?

- Do I have a waiting period? And when does it end?

- What kind of Surgical treatment is NOT covered?

About Our Fee Policy?

Medicare Gap for Out Patient Services?

The Medicare Rebate for an outpatient service is 85% of the MBS schedule fee.

The “gap” between the amount charged and this 85% rebate is not covered by your private health insurance for outpatient services and therefore a financial obligation on yourself arises, and you will face an “out-of-pocket” charge.

As a patient you pay 15% of the MBS fee, plus any amount charged by the doctor over the MBS fee. Private health insurers are not allowed to provide cover for doctors’ fees for out-of-hospital services.

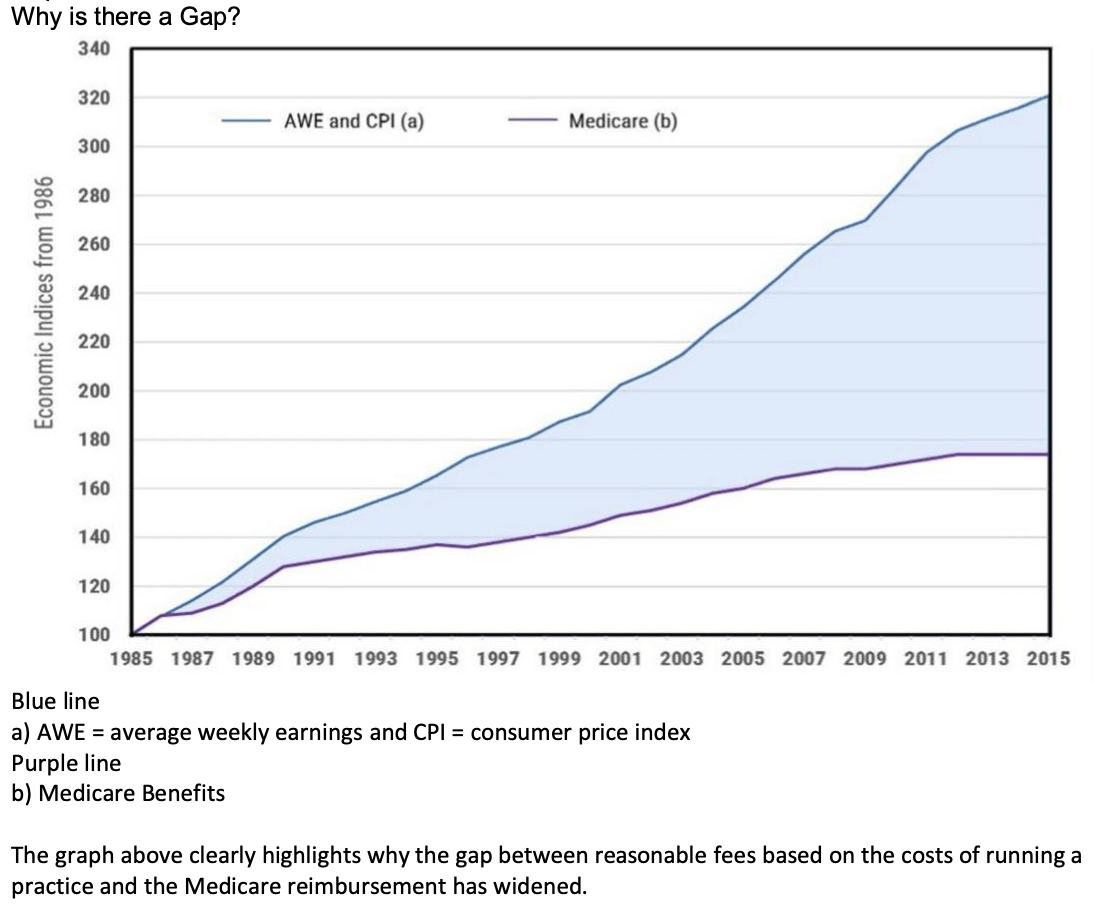

Medicare benefits levels are fixed arbitrarily by the federal government and benefit levels have not kept pace with inflation, the escalating costs of running a practice and increasing medical indemnity premiums, thereby widening the gap between reasonable fees and Medicare benefits.

The fees charged by our practice have been determined after careful study and investigation of practice costs and other relevant and material circumstances, and are considered as being fair, reasonable and appropriate for the services provided.

No Gap, Low Gap and Known Gap Policy

- No Gap

- Low Gap, and

- Known Gap

- Surgical examination and a consultation to address any and all of your questions and concerns regarding some specific conditions.

- Diagnostic examinations, and

- Where surgery is required, this may also be covered by our No Gap Policy

- Basic Surgical cover with your private health insurer,

- Your health fund card with you at the appointment,

- Insurance cover for the cost of the treatment. If your limit is reached for services provided or your health insurer paid zero dollars, you will have to pay the difference.

Uninsured Public Patients

- Go on a Waiting List at the Public Hospital, or

- Pay for the operation yourself ("Self Insure")